Select by Year:2025

|

Select by Topic:LegalFinancialHealthcareAll Tips |

|

Our newest Senior Tip:

Long Term Care

Tip – If you are looking for a long-term care facility be sure to do your research to find a facility that will meet your needs.

The most common long-term care facilities are skilled nursing facilities (SNFs) and assisted living facilities (ALFs). Here are the differences between SNFs and ALFs.

Skilled Nursing Facilities (SNFs)

- Provide 24-hour medical care supervised by licensed nurses

- Offer short-term rehabilitation services and long-term care

- Have medical professionals on staff (registered nurses, physical therapists)

- Typically have a more clinical, hospital-like setting

- Provide specialized medical services like IV therapy, wound care, and complex medication management

- Residents generally require a higher level of medical care and assistance with most activities of daily living

Assisted Living Facilities (ALFs)

- Provide housing, personal care, and support services

- Focus on assistance with activities of daily living (bathing, dressing, medication reminders)

- Less intensive medical oversight than SNFs

- Promote more independent living in a home-like environment

- Typically offer private or semi-private apartments or rooms

- Residents generally require less medical intervention but need some assistance with daily activities

The Idaho Administrative Code (IDAPA) for skilled nursing facilities is found in 16.03.02: “Skilled Nursing Facilities.”

The law governing assisted living facilities is found in Idaho Code Title 39, Chapter 33: “Idaho Residential Care or Assisted Living Act” and Idaho Administrative Code (IDAPA) 16.03.22: “Residential Assisted Living Facilities.”

The Licensing Authority in Idaho for Long Term Care Facilities is the Department of Health & Welfare Bureau of Facility Standards for Licensing and Certification. The phone number for skilled nursing facilities is (208) 334-6626. The phone number for assisted living facilities is (208) 334-1962.

Another source of information is the Idaho Ombudsman Program. An ombudsman is an advocate for residents in long term care facilities, including both skilled nursing facilities and assisted living facilities. The ombudsman provides information to residents and their families about long-term care options.

The program operates under the Idaho Commission on Aging and has regional offices throughout the state to serve residents in all areas of Idaho. The phone number for the Idaho Falls office is (208) 522-5391 and the phone number for the Pocatello office is (208) 233-4032.

Moving a loved one to a long-term care facility is a significant transition for a family and should be approached with patience, compassion, and thorough research.

View our “Senior’s Guide to a Well-Planned Future” on our website! Packer Elder Care Law – with you for life!

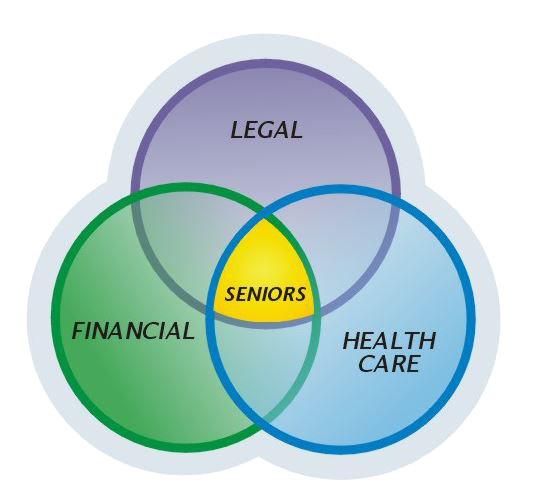

Tom Packer is an Elder Law Attorney serving all Southeast Idaho. As part of his law practice, Tom offers Life Care Planning to deal with the challenges created by long-term illness, disability and incapacity. If you have a question about a Senior’s legal, financial or healthcare needs, please call us.

March 2025